Everyone seems to be talking about disruption in their respective industries, but for some countries and regions, namely the UK, Europe and Australia, 2018 will see disruption mandated via legislation.

This year, three pieces of critical regulation come into place. For some firms, they are seeing these changes as a giant hassle, for others, they are seeing this as a huge opportunity and a pivot point for their industry. Let’s look at them in more detail.

1. General Data Protection Regulation (GDPR)

Region: All Europe member states including the UK

Implementation date: 25 May 2018

What is it?: GDPR is a regulation by which the European Parliament, the Council of the European Union and the European Commission intend to strengthen and unify data protection for all individuals within the European Union. The GDPR aims primarily to give control back to citizens and residents over their personal data and to simplify the regulatory environment for international business by unifying the regulation within the EU.

More information: ICO Website

One of the key impacts of GDPR is that citizens (customers of a particular company) can ask for all of the data held on them in electronic format. There are a number of implications for firms, especially that of data protection, but also making it easier for consumers to ask for copies of the information held on them in electronic format. This last point has the potential to be a revolution for consumers.

I have written before about the GDPR opportunity, and instead of companies seeing GDPR as an imposition, they can turn it into an opportunity to have a much closer relationship with their customers, or instead understand that a particular customer may have no such interest in a relationship, thus saving them money in trying to continually market to them.

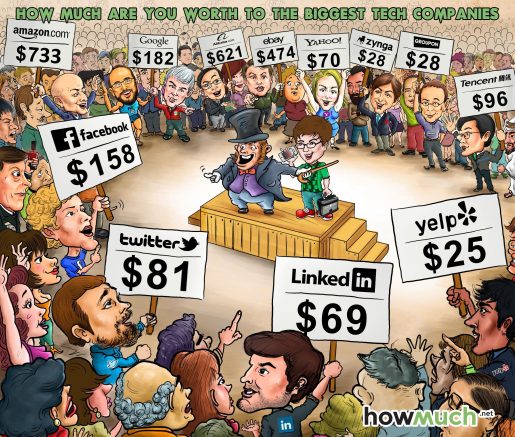

I think that GDPR will give rise to a new class of consumer, the data-savvy consumer who not only realises what data is held on them, they understand the true value of this data. The picture below shows a representation from 2015 of what website howmuch.com figured that data held by the various platforms mentions was worth to them.

Once consumers can start to own their own data, with GDPR as the catalyst, and with technologies such as blockchain as the enabler, the balance of power between consumer and supplier will change forever.

I believe that this one piece of legislation has possibly the longest-term impact on how consumers perceive their personal data.

2. Payment Services Directive number 2 (PSD2)

Implementation date: 13 January 2018 – but 5 of the 9 UK banks were not ready on this date and asked for extensions.

What is it?: Of most interest is the fact that PSD2 mandates an open banking platform, forcing financial institutions to offer connections via APIs (Application Programming Interfaces) to allow 3rd parties authorised access to an individual’s banking details.

An example of this is the announcement from HSBC that they will be offering an app in “early 2018” that will allow customers to see all of their accounts on one screen, no matter who they bank with.

More information: can be found here.

I’ve written about PSD2 before, and as the implementation date gets closer, it will be fascinating to see what each of the major bank’s releases. This piece of legislation not only drags the incumbent banks (some screaming) into the 21st century, it also unlocks a whole sub-industry in that Financial Technology (or FinTech) startups can develop innovative and revolutionary products and services to truly benefit consumers.

I was at one of Barclays own FinTech incubators: Rise in London recently for a workshop explaining what Barclays was doing to expose their banking platform via APIs.

While I am sure the other major banks are developing fantastic open access to their platforms, only Barclays seems to be putting their money where their mouth is and allowing FinTechs to rent desk space in a Barclays facility.

Expect to see some real leapfrog innovations from the Fintech, InsureTech, Proptech and MarTech sectors in 2018 and beyond as a result of PSD2.

3. The National Payments Platform (Australia)

Implementation Date: Early 2018

What is it?: The NPP will be an open-access infrastructure for fast payments in Australia. The NPP is being developed via industry collaboration to enable households, businesses and government agencies to make simply addressed payments, with near real-time funds available to the recipient, on a 24/7 basis.

Translation: If you’ve ever wondered why it takes days for payments between banks to clear when you can send money with PayPal instantly, then NPP is the solution. It’s hard for me to understand why in 2018 we have to mandate to banks to pay us instantly – but this will be a huge step forward for Australian consumers.

More information: can be found on the National Payments Platform website.

MY POV

All of these initiatives all have been 4 or more years in the making – directives by well-advised governments looking to stimulate competition and drive change. But what disruptive legislation is being prepared at the moment?

I think the cycle times for disruptive legislation will be much shorter going forward – they have to be.

Incumbents now have the framework for things like the open banking platform to innovate faster and we should expect those ecosystem participants in FinTech, InsureTechm, PropTech and MarTech will help to drive change much faster than ever before.

Some organisations will innovate naturally, as it is in their DNA, some will have to because of the regulation and some won’t know what to do beyond what the legislation forces them to do.

Not surprisingly, when I asked two senior people at two large UK banks if they would have innovated in the way the PSD legislation has forced them to, both said no. <facepalm>. That is, of course, the wrong answer, and proves why sometimes Governments have to mandate this disruption as a dose of medicine (for their “own good”) in industries that stubbornly refuse to change their ways of operating, and in turn hold back innovation that should be there to stimulate industry growth, as well as give rise to a better customer experience.

Not surprisingly, when I asked two senior people at two large UK banks if they would have innovated in the way the PSD legislation has forced them to, both said no. <facepalm>. That is, of course, the wrong answer, and proves why sometimes Governments have to mandate this disruption as a dose of medicine (for their “own good”) in industries that stubbornly refuse to change their ways of operating, and in turn hold back innovation that should be there to stimulate industry growth, as well as give rise to a better customer experience.

What you should be thinking about now:

Other countries and regions will be watching very closely to see what happens with each of these initiatives. Of interest will be how parallel industries respond. Given the mandate for an open banking platform, owners of utilities such as gas, electricity, water, telco and the like should expect to be legislated into this space before 2022.

Anticipating the need to deal with customers and other companies via open standards should not only be on your agenda, they should be in active development NOW! Don’t wait to be regulated into developing open standards, watch the PSD2 and NPP launches closely, and understand how you can step up to the mark.

Don’t ask IF you will be disrupted, or legislated into a disruptive position, accept you WILL and start developing a response in Q1 2018.

Many people have asked me how they can navigate the GDPR legislation and become GPDR ready.

For those in London, I have partnered with a GDPR expert to host a series of day-long GDPR workshops that will ensure you are GDPR ready.

Everything you need is included:

- Workbook

- Gap analysis questionnaire

- Readiness dashboard

- Action plan

- Checklists

- Full guide and toolkit

- Editable template documents

Head to futur.st/get-gdpr-ready and take advantage of a 50% discount.